HDFC Standard Life Insurance Company Ltd is Mumbai based life

insurance provider in India. It offers a wide range of individual and

group insurance solutions including Protection, Pension, Savings &

Investment and Health, along with Children’s and Women’s Plan. HDFC

Standard Life Insurance is considered to be the most profitable life

insurance company, calculated on Value Of New Business or VNB, amongst

the top 5 private life insurance companies in India. They are launching

their first ever initial public offering

in November 2017. Let us discuss the HDFC Standard Life IPO review in

this post with discussing the issue date, issue price, issue prospectus

and issue GMP.

About HDFC Standard Life Insurance Company Ltd IPO :

Objectives of the issue:

Promoters of the company :

Company Financials:

About HDFC Standard Life Insurance Company Ltd IPO :

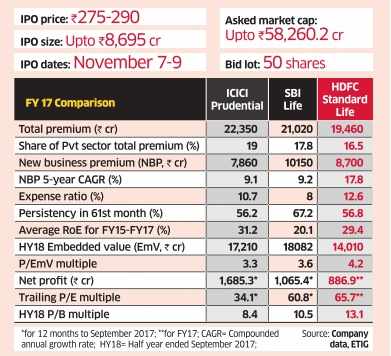

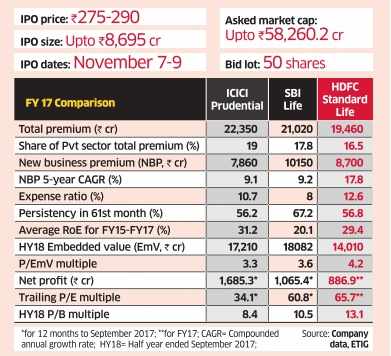

- IPO opens on – November 7, 2017.

- IPO closes on – November 9, 2017.

- Face value – Rs 10 Per Equity Share.

- Issue price – Rs. 275 – Rs. 290 Per Equity Share .

- Issue type – Book Built Issue IPO.

- Offer For Sale – 299,827,818 shares.

- Minimum lot – Nil.

- Minimum order quantity – Nil.

- Retail Allocation – 35%

- Issue size – Rs. 8245.26 crores – Rs. 8695.01 crores.

- Listing exchange – BSE, NSE.

- Draft prospectus – Download.

Objectives of the issue:

- The benefits of listing achieve the Equity Shares on the Stock Exchanges.

- The sale of Offered to carry out Shares by the Selling Shareholders.

- HDFC Standard Life Insurance Company Ltd has been incorporated in 2000.

- This is a joint venture between HDFC and Standard Life Aberdeen plc.

- HDFC Standard Life Insurance Company Ltd is a leading financial service provider in India offering finance for housing, banking, life and general insurance, asset management, venture capital and education loans.

- Standard Life is an Edinburgh based investment company offering a wide range of financial services across the globe. It is a public company established in 1825.

- This company sells policies through a multi-channel network. Like direct sales through own branches, Insurance agents, Partner Banks and through other financial institutions.

- HDFC Life is present in all over India. They have 414 branches and spoke branches and over 11200 bancassurance branches all over India through their top fifteen bancassurance partners. They also have more than 15000 full-time employees all over India. The company also has around 60000 individual insurance advisors.

Promoters of the company :

- Housing Development Finance Corporation Limited (“HDFC”).

- Standard Life (Mauritius Holdings) 2006 Limited (“Standard Life Mauritius”).

- Standard Life Aberdeen plc (“Standard Life Aberdeen”).

Company Financials:

VALUATION AND RECOMMENDATION

The embedded value (EmV) of a life insurance company tends to capture the longterm profitability of the existing business.Based on this parameter, the IPO is valued at 4.2 times the EmV at the end of September 2017, which is steeper compared with the multiple of 3.3 for ICICI Pru and 3.6 for SBI Life. The IPO is expensive even on the conventional valuation parameters including price earnings (PE) and price-book (PB) multiples. HDFC Standard Life has been growing new business faster with better mix, which may partially justify the premium valuation. Given these factors, the issue is more suitable for investors with .

This year this is the second life insurance company to get listed on the stock exchanges after SBI Life Insurance IPO. The other private life insurer ICICI Prudential Life Insurance Company Limited has already clocked a high of above Rs. 500 from its issue price of Rs. 330. So its time for HDFC Standard Life to join the same club. But the grey market premium is mere 18-20 rupees. The insurance industry is quite competitive and the real growth is available only in the long term. We believe some mergers will happen in this industry. Hence our HDFC Standard Life IPO review has a NEUTRAL view on this issue. Long-term investors can think to invest. We don’t expect a dramatic listing gain.

Next Read: The Truth behind DCB bank bullish report.

The embedded value (EmV) of a life insurance company tends to capture the longterm profitability of the existing business.Based on this parameter, the IPO is valued at 4.2 times the EmV at the end of September 2017, which is steeper compared with the multiple of 3.3 for ICICI Pru and 3.6 for SBI Life. The IPO is expensive even on the conventional valuation parameters including price earnings (PE) and price-book (PB) multiples. HDFC Standard Life has been growing new business faster with better mix, which may partially justify the premium valuation. Given these factors, the issue is more suitable for investors with .

Based

on this parameter, the IPO is valued at 4.2 times the EmV at the end of

September 2017, which is steeper compared with the multiple of 3.3 for

ICICI Pru and 3.6 for SBI Life. The IPO is expensive even on the

conventional valuation parameters including price earnings (PE) and

price-book (PB) multiples. HDFC Standard Life has been growing new

business faster with better mix, which may partially justify the premium

valuation. Given these factors, the issue is more suitable for

investors with ..

HDFC Standard Life IPO Review:This year this is the second life insurance company to get listed on the stock exchanges after SBI Life Insurance IPO. The other private life insurer ICICI Prudential Life Insurance Company Limited has already clocked a high of above Rs. 500 from its issue price of Rs. 330. So its time for HDFC Standard Life to join the same club. But the grey market premium is mere 18-20 rupees. The insurance industry is quite competitive and the real growth is available only in the long term. We believe some mergers will happen in this industry. Hence our HDFC Standard Life IPO review has a NEUTRAL view on this issue. Long-term investors can think to invest. We don’t expect a dramatic listing gain.

Next Read: The Truth behind DCB bank bullish report.

No comments:

Post a Comment