L&TFH is a holding company. A holding company is a legal entity that has no business of its own but holds a majority stake in other companies. These companies make money by getting dividends from its subsidiary companies and provide low-cost financing to their subsidiaries.

Holding companies are the best businesses for long-term investors because of following reasons:

Diversified business: Holding companies have a majority stake in multiple businesses, in diversified sectors, in case of L&TFH, the company has the majority stake in financial services companies engaged in mutual funds, retail loans, infra project financing etc. This gives relative safety to the company because if none of the subsidiaries doesn't perform well or goes bust, Holding company will lose a small part of a business.

Multiple sources of income: Holding companies get paid in the form of dividends that are paid by its subsidiaries. Since a holding company has multiple subsidiaries, it has multiple sources of income.

Monopolistic position: Holding companies usually have a monopolistic position in the market or the sector they are working in. This monopoly is created by acquiring small players in the market, which could be a threat to the company’s business in the future. By acquiring these players, holding companies not only kill their competition but are able to control the market or the sector in a better way.

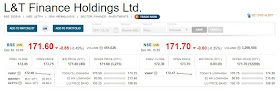

Now let us talk about L&TFH as a business.

Business and revenue:

L&TFH is a holding company that has many subsidiaries such as:

L&T Finance: Company is engaged in providing finance for two-wheeler, farm equipment, microloans and real estate finance

L&T Capital markets which is engaged in wealth management, the company manages the wealth of its client and provides customized products and services.

L&T Investment Management: Company provides financial products such as mutual funds and SIP services based on a customer’s financial goals.

L&T Housing finance: Company provides retail home loans, Top Up loans on existing house loans, balance transfer service etc.

L&T Infra debt fund: Provides low-cost long-term debt financing to infrastructure projects.

L&T Infrastructure Finance company: Provides project finance, financial advisory services and debt refinance facilities.

L&TFH is an NBFC, promoted by the same promoter group as of L&T. The promoter holds almost 64% of the total shareholding in the company.

Past performance:

The company has posted good growth in this sector. In the past 5 years, company’s sales have doubled, from Rs. 3,900 crores in 2013 to 8,500 in 2017.

Company’s profit has increased by 43% in the past 5 years from Rs. 730 crores in 2013, to Rs. 1,042 crores in 2017.

Since L&TFH is a holding company, its major source of income is from dividends from its subsidiary companies. Almost 81% of the company’s earnings come from dividend from its subsidiaries.

Company’s average ROCE for the past 3 years has been pretty high at 41%.

Since the company has such a diverse portfolio of businesses, it is safer bet compared to other companies that rely on a single business for their revenue generation.

lookings the past performance of the company it can be said that company is doing a good business and has a bright future ahead.

You may buy L&TFH stocks on dips if you are a long-term investor (that is if your investment horizon is above 2-3 years up to 5-10 years)

Previous Read: What is RSI Relative Strength Index of a stock

Next Read : Shalby Hospital IPO Review

Previous Read: What is RSI Relative Strength Index of a stock

Next Read : Shalby Hospital IPO Review

No comments:

Post a Comment