About The Byke Hospitality Ltd.

The Byke Hospitality Ltd., incorporated in the year 1990, is a Small Cap company (having a market cap of Rs 741.01 Crore) operating in Hospitality sector.

The Byke Hospitality Ltd. key Products/Revenue Segments include Income from Rooms, Restaurants & Other Services which contributed Rs 269.98 Crore to Sales Value (100.00 % of Total Sales)for the year ending 31-Mar-2017.

For the quarter ended 30-09-2017, the company has reported a Standalone sales of Rs 29.41 Crore, down -20.67 % from last quarter Sales of Rs 37.07 Crore and down -45.12 % from last year same quarter Sales of Rs 53.59 Crore Company has reported net profit after tax of Rs 5.21 Crore in latest quarter.

The company’s top management includes CA.Ram Ratan Bajaj, Mr.Anil Patodia, Mr.Bharat Thakkar, Mr.Dinesh Kumar Goyal, Mr.Pramod Patodia, Mr.Ramesh Vohra, Mr.Sandeep Singh, Mr.Satyanarayan Sharma, Mr.Vikash Agarwal, Mrs.Archana Anil Patodia. Company has A P Sanzgiri & Co. as its auditoRs As on 30-09-2017, the company has a total of 40,097,800 shares outstanding.

Technicals :

The Byke Hospitality Ltd shares was moving today on volatility 1.03% or 1.85 from the open. The NSE listed company saw a recent bid of 181.00 and 15279 shares have traded hands in the session.

One of the most famous sayings in the stock market is “buy low, sell high”. This may seem like an oversimplified statement, but there are many novice investors who often do the complete opposite. Many investors may be looking too closely at stocks that have been on the rise, and they might not be checking on the underlying fundamental data. They may be hoping to ride the wave higher, but may end up shaking their heads. On the flip side, many investors may hold onto stocks for far too long after they have slipped drastically. Waiting for a bounce that may never come can cause frustration and plenty of second guessing. Successful investors are typically able to locate stocks that are undervalued at a certain price. This may take a lot of practice and dedication, but it may do wonders for the health of the portfolio.

Digging deeping into the The Byke Hospitality Ltd ‘s technical indicators, we note that the Williams Percent Range or 14 day Williams %R currently sits at -45.23. The Williams %R oscillates in a range from 0 to -100. A reading between 0 and -20 would point to an overbought situation. A reading from -80 to -100 would signal an oversold situation. The Williams %R was developed by Larry Williams. This is a momentum indicator that is the inverse of the Fast Stochastic Oscillator.

Investors are paying close attention to shares of The Byke Hospitality Ltd . A popular tool among technical stock analysts is the moving average. Moving averages are considered to be lagging indicators that simply take the average price of a stock over a specific period of time. Moving averages can be very useful for identifying peaks and troughs. They may also be used to help the trader figure out proper support and resistance levels for the stock. Currently, the 200-day MA is sitting at 182.21, and the 50-day is 165.22.

The Byke Hospitality Ltd currently has a 14-day Commodity Channel Index (CCI) of 45.14. Active investors may choose to use this technical indicator as a stock evaluation tool. Used as a coincident indicator, the CCI reading above +100 would reflect strong price action which may signal an uptrend. On the flip side, a reading below -100 may signal a downtrend reflecting weak price action. Using the CCI as a leading indicator, technical analysts may use a +100 reading as an overbought signal and a -100 reading as an oversold indicator, suggesting a trend reversal.

The RSI, or Relative Strength Index, is a widely used technical momentum indicator that compares price movement over time. The RSI was created by J. Welles Wilder who was striving to measure whether or not a stock was overbought or oversold. The RSI may be useful for spotting abnormal price activity and volatility. The RSI oscillates on a scale from 0 to 100. The normal reading of a stock will fall in the range of 30 to 70. A reading over 70 would indicate that the stock is overbought, and possibly overvalued. A reading under 30 may indicate that the stock is oversold, and possibly undervalued. After a recent check, the 14-day RSI for The Byke Hospitality Ltd is currently at 63.81, the 7-day stands at 66.67, and the 3-day is sitting at 73.61.

Another technical indicator that may be a powerful resource for determining trend strength is the Average Directional Index or ADX. The ADX was introduced by J. Welles Wilder in the late 1970’s and it has stood the test of time. The ADX is typically used in conjunction with the Plus Directional Indicator (+DI) and Minus Directional Indicator (-DI) to help spot trend direction as well as trend strength. At the time of writing, the 14-day ADX for The Byke Hospitality Ltd is noted at 34.56. Many technical analysts believe that an ADX value over 25 would suggest a strong trend. A reading under 20 would indicate no trend, and a reading from 20-25 would suggest that there is no clear trend signal.

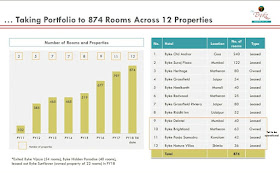

- Company operates on asset light model (allows significant profitability from low asset base) as properties are taken on long term lease,they operate 12 properties,3 were added in December 2017.

- The revenue of the company is growing at 34% CAGR in last 4 years.

- According to latest AGM of the company,they are focussing on increasing the hotels under it to 25 by 2020.The company focuses on domestic middle class leisure tourism which is set to grow at faster pace.The management is focused on creating ‘Byke’ as a leading hospitality brand in the country and has given a revenue guidance of Rs.500 crore by FY21 (current TTM revenue is Rs.262 crore).The tourism and hospitality industry has a very bright future with the rising consumer disposable income, better infra connectivity (road, rail and airlines),attractive tourist destinations (including heritage and cultural sites, scenic places, coastal beaches, etc.)and higher spending on tourism

- The company is available at PE of just 23.71 whereas industry PE 71,so it is cheap compared to peers.Company has posted profit of 31.70 Cr in FY17 compared to profit of 25.94 Cr in FY16 showing 22.20% rise in profits on just 16.6% higher sales, margins have improved

- It has an equity capital of 40.10 crore and reserves of Rs.107.94 crore,Debt on the company is just 6.41crore so virtually it is a DEBT FREE company

- The promoter has bought shares of the company in December 2017 from open market,which gives very bullish sign that management is confident.

- The Byke Hospitality has acquired 3 hotels in December 2017 , viz. The Byke Nature Villas (35 Rooms) in Shimla, The Byke Puja Samudra (42 Rooms) in Kovalam, and The Byke Brightlands Resort (63 Rooms) in Matheran.

- The Byke Hospitality is a fast emerging name in the hospitality sector with luxury resorts and boutique hotels under its banner. Equipped with years of experience, the group is committed towards quality and excellence, providing its patrons with the finest of holiday experiences.

- The stock looks undervalued compared to peers and the business model they follow is good, promoters buying from open market gives a bullish signal, Company showing good growth.

- It is being seen as a Perfect candidate for Re-Rating.

Outlook :

The stock may reach up to to 245-250 Rs in short term duration of 6 months. and may create more value for investors with long term horizon.

Next Read : Bliss GVS Pharma : A Contra Play from Pharma Sector

Previous Read : Orient Paper and Industries :Switch To Smart-Value Unlocking with Demerger

No comments:

Post a Comment