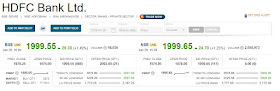

HDFC

Bank continued to deliver a healthy performance on business growth and

operating front in 3QFY18, led by strong growth in loan book,

best-in-class NIMs of 4.3%, and higher fee-based and forex income. While

the Bank’s loan book grew by 27.5% YoY and 4.4% QoQ to Rs6,312bn owing

to strong sequential growth in Retail (4.8% QoQ), Business Banking (4.5%

QoQ) and Corporate Banking segment (4% QoQ), its deposits grew by 10.1%

YoY and 1.4% QoQ to Rs6,990bn in 3QFY18. Notably, the Bank’s annual

growth rate in loan and deposit seems to be incoherent owing to the

demonetisation base. Its NII grew by 24.1% YoY and 5.8% QoQ to Rs103.1bn

aided by higher loan growth

and healthy margin. Its net profit grew by 28% YoY and 8% QoQ to

Rs84.5bn, which adjusted for provisioning grew by 20.1% YoY (+11.8% QoQ)

to Rs46.4bn. Following the decision of Joint Lenders Forum (JLF), the

Bank has upgraded one large corporate account to standard account. Post

2QFY18 results the Bank had downgraded the same account to NPA on the

RBI’s advice during Assets Quality Review (AQR) of FY17.

Management Commentary & Guidance

- Contingent provisioning of Rs7bn made in 2QFY18 for a large corporate account has not been reversed, out of which ~Rs3.5bn moved to floating provisioning and remaining Rs3.5bn went into general provisioning towards Agri and other bad loans. As of Dec’17-end, the Bank was carrying floating provisioning to the tune of Rs13.3bn.

- The Bank will continue to focus on Agri book, as this segment continues to be a profitable business proposition. Marking a substantially rise over the last one year, its NPA from the Agri book touched level of 5-6% at gross level. However, the Bank does not see any material change in its credit cost due to higher level of NPA from Agri segment.

- The Bank is in process to raise Rs240bn of equity capital over next few years to support its loan growth and meeting higher capital requirement due to its classification as systematically important bank by the RBI.

Outlook & Valuation

Despite

adverse operating environment, HDFC Bank continued to deliver strong

performance on business growth as well as operating and asset quality

front. The Bank is in process to raise Rs240bn of fresh equity in 4QFY18

via QIP and preferential placement to HDFC. As the dilution is expected

to be book value accretive, we expect book value of the Bank to

increase by ~12-14% on QoQ basis. Further, incremental capital will help

the Bank to support its growth plan over next 3-4 years. Hence,

upwardly revising book value and profit estimates by 31% and 23%,

respectively for FY19, we maintain our BUY recommendation on the stock

with a Target Price of Rs2,285 based on

4.3x FY19E Adjusted book value.

eToro is the #1 forex trading platform for beginner and full-time traders.

ReplyDelete