No sooner had It seemed that we are in an optimism phase, The BSE Small Cap Index is down 10.6%, BSE Midcap Index is down 7.9% and the BSE Sensex is down 2.7% over this week.

Although Global markets have been jittery since the beginning of the year with US 10-Year interest rates moving up, and the stocks which had seen some signs of Euphoria coming down sharply closer home, the Budget has played a big role in this sharp fall.

This begs a question, Is the government trying to bring the market down? In the period 2010-2013, the Singapore government put in a lot of measures to control the speculation and the rise in the property market as it started impacting the economy according to them. The rising property market made “hot money” move to Singapore and also increased the cost of doing business in Singapore. The government measures were aimed to bring macroeconomic stability.

Is the introduction of Long Term Capital Gains in the budget a similar move where the government is trying to limit the allocation of money to the stock market? Hon. Finance Minister's speech seems to hint that for sure. Here's some of what he said as a preamble to introducing the LTCG: “With the reforms introduced by the Government and incentives given so far, the equity market has become buoyant.” “Major part of this gain has accrued to corporates and LLPs.” “This has also created a bias against manufacturing, leading to more business surpluses being invested in financial assets.” (unfortunately, no one can deny this observation)

Barring the Tax and possibly their intent, I feel the budget was not as bad as the market reaction suggests. Given the fiscal situation of India, a budget is always a balancing act and the government has to decide where they focus their resources on. This government has been consistent in focusing on the “Supply Side factors” like infrastructure and “Inclusive Growth” and this budget they have done the same.

The budget is pro-growth, following 12.3% growth in total spending in FY18, the government has budgeted a growth of 10% for FY19. Focus on infrastructure has continued. Railways, Roads, Defense and Agricultural capex have seen the highest growth.

The inclusive part of the budget can be seen from the increase in MSP for crops to 1.5 times production cost to ensure higher realizations for farmers' agricultural produce and also the announcement of National Health Protection Scheme.

|

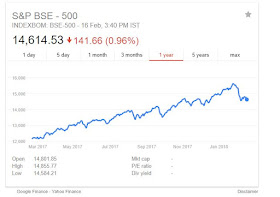

| BSE 500 Index -1 Year Returns |

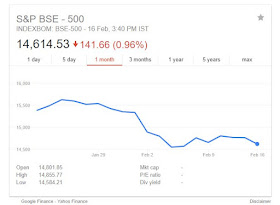

|

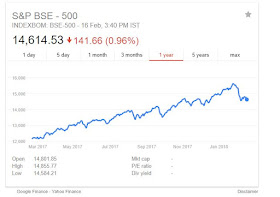

| BSE 500 Index -5 Year Returns |

|

I believe that the long-term fundamentals of the India story are intact. This can be seen in BSE 500 1 year and 5-year returns in the picture above .The Market reaction to the budget is similar to that when PM Modi announced Demonetisation. That too had interrupted the Optimism phase for a while. I believe that when the dust settles down, and I have no clue how long that will take, the market will be back to fundamentals. The interruption can be much longer if the government does not want the markets to go up though!

Next Read : The Era of Easy Money is Coming to an End. What Happens Now?

|

eToro is the ultimate forex trading platform for new and professional traders.

ReplyDeleteThanks. I am regularly following you. Your posts always contain some good information and your way of explanations is very very good. See marksans pharma news

ReplyDeleteWell Said. I am expecting more posts from you.I am regularly following you. Your posts posses some good information .colgate palmolive share price bse

ReplyDelete