People

indulging in the stock market are often people with a lot of emotions.

They get excited by something new, especially if it holds the promise of

making them a whole lot richer and provides bragging rights at their

next social gathering.

Maybe that’s why amateur and professionals alike tend to lose their

minds in bull markets, particularly when a hot initial public offering,

or IPO, is offered to them by their broker.

On one hand, had you bought into the IPOs of Infosys (yes,

remember?), HDFC Bank, Sun Pharma, or TCS, you would have had some

volatile price fluctuations along the way, but there is no question that

you have made enough money to substantially change the quality of your

life. Clearly, a well chosen IPO can be a life changing experience if

you simply make the right choice and stick with the stock for years.

On the other hand, there is a large majority of IPOs such as those of

Reliance Power, Suzlon and DLF, which have destroyed investors’

capital. With such businesses, even the “long-term” cannot save you from

permanent capital destruction.

The Truth about IPOs

Benjamin Graham wrote in The Intelligent Investor…

In every case, investors have burned themselves on IPOs,

have stayed away for at least two years, but have always returned for

another scalding. For as long as stock markets have existed, investors

have gone through this manic-depressive cycle.

In America’s first great IPO boom back in 1825, a man was said to

have been squeezed to death in the stampede of speculators trying to buy

shares in the new Bank of Southwark. The wealthiest buyers hired thugs

to punch their way to the front of the line. Sure enough, by 1829,

stocks had lost roughly 25% of their value.

Over my 11 years of experience in the stock markets, I have rarely

come across any IPO that has been launched keeping in mind the interest

of investors.

A majority of them have been launched in the form of ‘legalized looting’ by company promoters and their investment bankers.

I have come to believe how Graham defined IPOs in

The Intelligent Investor.

He said that intelligent investors should conclude that IPO does not

stand only for ‘initial public offering’. More accurately, it is a

shorthand for…

- It’s Probably Overpriced, or

- Imaginary Profits Only, or even

- Insiders’ Private Opportunity

3 Reasons to Avoid IPOs

There is an old saying in corporate circles. One should raise money when

it is available rather than when it is needed. This is the reason most

companies come out with their IPOs during rising or bull markets when

money is aplenty.

Unfortunately, most investors in these IPOs come out on the losing end of the equation.

Granted, some IPO deals are good for retail investors, but I’d argue the odds of that happening are stacked against you.

The stock market regulator SEBI’s rules that are designed to protect

Indian IPO investors, generate reams of disclosures about the company

and the offering process but unfortunately, many investors neither read

nor understand these.

After all, how many people have the time or inclination to read

400-500 pages of IPO offer documents? And then they say – “Please read

the offer document carefully before investing.”

IPOs are not level playing fields, I believe. This game is stacked

heavily against the small investor who is lured into the hype and then

often loses a large part of his savings betting on listing gains.

Here are 3 reasons I believe small investors must avoid IPOs and

rather search for great businesses among those already listed –

1. IPOs are Expensive

People assume an IPO is an opportunity to “get in at lower prices”. In

reality, by the time you buy shares of a company in its IPO, other

parties have almost always invested earlier at lower prices – often,

much lower prices.

Before you even knew about the company, there probably were three or

four rounds of private investment, and the per-share price of ownership

usually goes up with each round.

In fact, one of the big incentives for an IPO is so that previous

investors – founders, venture capital firms, large individual investors –

can “cash out” at least a portion of what they’ve invested.

That is why most IPOs are often expensively priced. They are not

priced to offer you a piece of the business at cheap or reasonable

prices, but to find “bigger fools” who can get in when the “privileged

few” are getting out.

Don’t believe the investment bankers when they say that IPOs are

“cheap and attractive”. Their incentive lies in first fixing the IPO

price (whatever the promoter wants) and then working backward to justify

the same.

2. IPOs Create Vividness Bias

It’s important to understand that the investment bankers and underwriters of IPO are simply salesmen.

The whole IPO process is intentionally hyped up to get as much

attention as possible. Since IPOs only happen once for each company,

they are often presented as “once in a lifetime” opportunities for the

promoters and other large shareholders to cash out.

Promoters and investment bankers thus create stories that are “vivid” –

by using terms like “listing gains”, “bright future”, “long-term story” –

and entice you to believe them as soon as you hear them.

You must avoid getting charmed by that vividness.

Try to go behind the beauty of that vividness, and scrutinize the IPO to see if it is really so bright and beautiful.

In other words, you need to get past the “bright and shiny” stuff

that surrounds IPOs because it’s easy to fall into the trap given that

so many others around you are falling for the same.

Don’t buy a stock only because it’s an IPO – do it because it’s a good investment.

3. IPOs Underperform

Most people who get onto the IPO bandwagon often look at the listing or

short term gains they can make in the next few weeks and months. In bull

markets, this often happens.

However, if you consider the long term performance of IPOs, most of

them underperform their peers and the general market – simply because

they started off with high valuations.

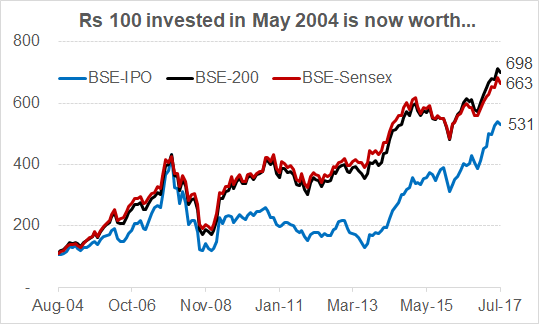

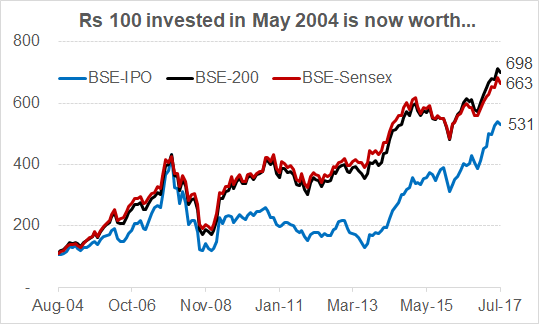

As you can see in the chart below, the BSE-IPO index has

underperformed both the BSE-30 and BSE-200 indices ever since this index

was launched in 2004.

Data Source: BSE’s Website

So much for the hype!

Final Word

Here are some thoughts on IPOs from a few of the investing legends…

Warren Buffett wrote in his 1993 letter…

[An] intelligent investor in common stocks will do better in

the secondary market than he will do buying new issues…[IPO] market is

ruled by controlling stockholders and corporations, who can usually

select the timing of offerings or, if the market looks unfavourable, can

avoid an offering altogether. Understandably, these sellers are not

going to offer any bargains, either by way of public offering or in a

negotiated transaction.

When Buffett issued Class-B shares of Berkshire, he made sure that it wasn’t a typical IPO. He wrote in his 1997 letter…

Our issuance of the B shares not only arrested the sale

of the trusts, but provided a low-cost way for people to invest in

Berkshire if they still wished to after hearing the warnings we issued.

To blunt the enthusiasm that brokers normally have for pushing new

issues—because that’s where the money is—we arranged for our offering to

carry a commission of only 1½%, the lowest payoff that we have ever

seen in common stock underwriting. Additionally, we made the amount of

the offering open-ended, thereby repelling the typical IPO buyer who

looks for a short-term price spurt arising from a combination of hype

and scarcity.

The dot com crash of 2000 was preceded by hundreds of IPOs where the

underlying business was literally nonexistent. In his 2001 letter,

Buffett wrote…

The fact is that a bubble market has allowed the creation

of bubble companies, entities designed more with an eye to making money

off investors rather than for them. Too often, an IPO, not profits, was

the primary goal of a company’s promoters. At bottom, the “business

model” for these companies has been the old-fashioned chain letter, for

which many fee-hungry investment bankers acted as eager postmen.

Benjamin Graham wrote in Chapter 6 of

The Intelligent Investor…

Our one recommendation is that all investors should be

wary of new issues—which means, simply, that these should be subjected

to careful examination and unusually severe tests before they are

purchased. There are two reasons for this double caveat. The first is

that new issues[IPO] have special salesmanship behind them, which calls

therefore for a special degree of sales resistance. The second is that

most new issues are sold under “favorable market conditions”—which means

favorable for the seller and consequently less favorable for the buyer.

Charlie Munger said this in Berkshire’s 2004 meeting…

It is entirely possible that you could use our mental

models to find good IPOs to buy. There are countless IPOs every year,

and I’m sure that there are a few cinches that you could jump on. But

the average person is going to get creamed. So if you’re talented, good

luck.

To which Buffett added…

An IPO is like a negotiated transaction – the seller

chooses when to come public – and it’s unlikely to be a time that’s

favorable to you. So, by scanning 100 IPOs, you’re way less likely to

find anything interesting than scanning an average group of 100 stocks.

Buffett also said…

It’s almost a mathematical impossibility to imagine that,

out of the thousands of things for sale on a given day, the most

attractively priced is the one being sold by a knowledgeable seller

(company insiders) to a less-knowledgeable buyer (investors).

The late Mr. Parag Parikh wrote in his book, Value Investing and Behaviour Finance…

It’s safe to conclude that IPOs, which seem like a good

investment vehicle are, in reality, not so. In fact, an IPO is a product

which is against investor interest, as it is mostly offered to

investors when they are willing to pay a higher and outrageous valuation

in boom times.

Prof. Sanjay Bakshi wrote this in a 2000 article …

Any kind of rational comparison of long-term returns in

the IPO market and the secondary market would show that investors do far

better in the latter than in the former…IPOs are one of the surest ways

of losing money in the long run.

Four characteristics of the IPO market makes it a market where it is

far more profitable to be a seller than to be a buyer. First, in the IPO

market, there are many buyers and only a handful of sellers. Second,

the sellers, being insiders, always know more about the company whose

shares are to be sold, than the buyers. Third, the sellers hold an

extremely valuable option of deciding the timing of the sale. Naturally,

they would choose to sell only when they get high prices for the

shares. Finally, the quantity of shares being offered is flexible and

can be “managed” by the merchant bankers to attain the optimum price

from the sellers’ viewpoint.

But, what is “optimum” from the sellers’ viewpoint is not the

“optimum” from the buyers’ viewpoint. This is an important point to

note: Companies want to raise capital at the lowest possible cost, which

from their viewpoint means issuance of shares at high prices. That is

why bull markets are always accompanied by a surge in the issuance of

shares.

You get the message, right?

It’s important to remember that, while most are, not every IPO is bad. It’s just that the base rate of investing in an IPO is not in favor of the small investor, and thus you must assess every investment opportunity on its own merit.

Hype and excitement don’t necessarily equate to a good investment

opportunity. If stocks continue to climb like they have over the past

few months, and the IPO line lengthens, I’m afraid you’ll have plenty of

opportunities to see that I’m right.

The article 3 Reasons IPOs Are Almost Always Bad Investments appeared first on Safal Niveshak.