The company operates through mix of owned & leased properties,management contracts and JVs with recently focus more shifting towards asset light management contract model.

It is present across all the major business destinations in the country and has strategy to explore tier II and pilgrimage destinations.

It operates under two brands: Royal Orchid and Regenta with presence across categories of 5-star business and leisure hotels, 4-star and long stay hotels, resorts and heritage hotels etc.

The Company’s sales offices are spread across India and the pan India sales team comprises of 100 executives. ROHL also provides training to its employees through its school of hotel management.

Thereby ensuring quality service throughout its properties

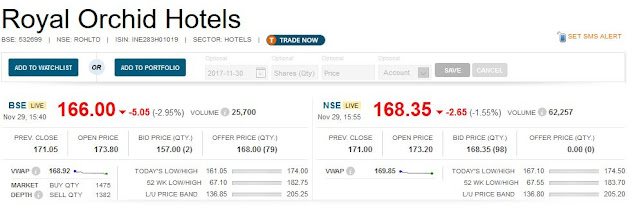

Shares of Royal Orchid Hotels

touched 52-week high of as it has announced partnership with UK-based Bespoke Hotels.

Bespoke Hotels has grown to represent and manage over 200 properties worldwide, with over 50 represented hotels in India, and stands as the UK’s Largest Independent Hotel Group.

Chender Baljee, founder of Royal Orchid Hotels, said, "We are thrilled to have Bespoke Hotels on board, to offer our guests 100’s of hotels abroad, and to market our hotels to inbound International travellers."

Stewart & Mackertich has initiated coverage on Royal Orchid Hotels (ROHL) with a Strong Buy

rating. Their rating underpins the company’s rapid expansion in the

hospitality space, its rich property portfolio, new hotel launches and

strong management bandwidth.

Investment highlights

Diversified portfolio across categories and locations:

The Company has 42 operational properties with a collective inventory of 3,159 rooms spread over 28 cities. The properties are spread across wide price categories ranging from 5-star to budget category rooms targeting leisure as well as business travelers. ROHL is all set to reach to 50 properties by the end of FY18.

Clear focus on management contracts implying asset light strategy:

The Company started its operations through the ownership model by setting up two hotels in Bangalore. However, over the past 3-4 years, it is increasingly focusing on expanding operations through management contracts and leasing rather than owning the properties. Under management contract, the company charges 2-3% of the revenue as management fees and an incentive fee which varies from 6%-8% of the gross operating profit. ROHL bears no expenses and even the onus of renovation of the property is on the property owner. Out of the 3,159 room keys, 2,112 rooms are under management contracts.

Reduction in GST rate to positively impact the Company:

Royal Orchid Hotels used to pay 21% tax under the pre-GST regime. The GST council has reduced the GST rate on restaurants in five-star and luxury hotels (room rent up to INR7,500) from 28% to 18%, bringing it on par with standalone air-conditioned restaurants. This move is expected to benefit the Company as a majority of Royal Orchid’s rooms fall under this bracket.

The business is expected to perk up from FY18

Asset Light Business Model (insignificant Capex): The Company started its operations through the ownership model by setting up two hotels in Bangalore. However, over the past 3-4 years, it is increasingly focusing on expanding operations through management contracts and leasing rather than owning the properties. Under management con-tract, the company charges 2-3% of the revenue as management fees and an incentive fee which varies from 6%-8% of the gross operating profit. Out of the 3,159 room keys 2,112 rooms are under manage-ment contracts.

Under this model, ROHL bears no expenses and even the onus of renovation of the property is on the property owner. In FY17, its consolidated revenues stood at INR162 Crores, apart from this, its revenues from managed properties stood at INR128 Crore. This is expected to go up significantly in the near future as all the 12 properties which it plans to add this fiscal would be under manage-ment contracts.

Improving Occupancy: Currently, ROHL is sitting at an occupancy of 69% across all of its hotels. However, some of its hotels such as Royal Orchid Central Pune and Royal Orchid Central Grazia, Navi Mumbai, the occupancy is close to 85%. Some of the new properties which have been added during the past two years haven’t achieved high occupan-cy which is averaging out the total group occupancies. This is poised to turnaround in the coming year when the occupancy goes up and reaches an optimum level. The company is planning to develop its land in Powai (Mumbai) under a joint development model (no upfront capex). Looking at the current occupancy rate of its property in Mum-bai, this seems to be a prudent decision, especially considering the fact that the hospitality industry is going through an up cycle.

Lower Finance Costs: The management’s efforts to reorganize the Company’s debt are paying off. ROHL’s debt have gone from a five-year to 10-year repayment period. The interest rates have also come down from about 16% to 13.50%, as a result the interest expense has come down from INR14.92 Crore in 2015 to INR12.15 Crore in 2016

Asset light business model, rapid expansion of properties, favorable taxation structure under GST, turnaround in business operations

coupled with ever increasing foreign tourist arrival and robust air passenger traffic bodes well for the company. We take into consideration the fact that the asset value of the current properties including (joint ventures) stands at INR500 Crore approximately.

We estimate that ROHL would generate a cash flow from operations of INR40 Crores by FY19. We value the company based on the above two facts and arrive at a target price of INR200 i.e of 30 % upside from the CMP of INR 160.

Next Read : Balaji Amines a high growth rider stock

Previous Read : Very important financial tips for individuals

No comments:

Post a Comment