DCB Bank continued to deliver healthy performance on all major metrics in 4QFY18 as well led by (a) strong growth in loan book (+28.6% YoY & 9.4% QoQ); (b) all-time high NIMs of 4.16% in FY18 vs. 4.04% in FY17; (c) strong growth in other income (+33.4% YoY & 13.2% QoQ); (d) continued sequential improvement in C/I ratio to 59.4% vs. 62.3% in 3QFY18; and (e) lower fresh slippages of Rs805mn vs. Rs1,031mn in 3QFY18. Led by 70% YoY and 16% QoQ improvement in upgrades and recovery from gross NPA to Rs667mn, its headline gross and net NPA ratio came in at 1.79% and 0.72%, respectively compared to 1.89% and 0.87% in 3QFY18. The Bank’s overall stressed loan portfolio, which improved sequentially, remains within the Management’s comfort zone.

Management Commentary & Guidance

- Loan book grew by 28.6% YoY and 9.4% QoQ to Rs203.4bn aided by CV, AIB, Corporate Banking and SME segments. Expecting 22-25% growth in loan book in FY19E, the Bank looks forward to double its loan book over the next 3-3½ years.

- All-time high NIMs is attributable to some attractive refinancing options used by the Bank. The Management expects NIMs to remain in 3.7-3.8% range on sustainable basis. The Bank expects cost of fund to stabilise at around current level.

- The Bank opened 56 new branches in FY18 and has completed physical expansion drive started in 2QFY16. Going forward, the Bank will expand branch network in a suitable manner without affecting its overall cost to income ratio as well as profitability.

- The Bank expects C/I income to improve owing to likely improvement in operational efficiency of existing branches and other distribution channels. It expects to reach C/I ratio of 55% by FY19-end from 59.4% in 4QFY18.

- The Management is quite comfortable till the gross NPAs remain below 2% and net NPA below 1%, as the Bank’s customers are predominately SME and mid-size business houses.

- Its core fee income is likely to grow at healthy pace in next few quarters led by strong growth in income from sale of Priority Sector Lending Certificate and 3rd party product distribution.

|

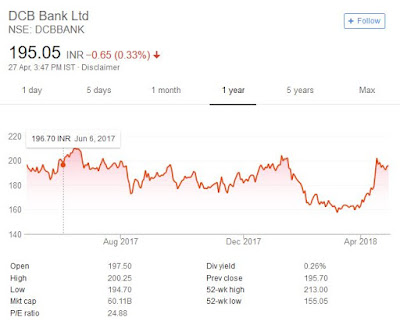

| DCB-Bank-Price trend |

Outlook & Valuation

Continuing to focus on increasing loan book in low-ticket Retail, SME and AIB segments, the Bank is augmenting its footprint both on physical and digital front. Though this aggressive expansion strategy might impact its return ratios in the near-term, we believe it is beneficial from long-term perspective. Further, the Management focuses on increasing efficiency of existing network to improve cost to income ratio in the long-term, which will lead to sustained earnings growth. As creditworthiness of its core client group from SME/MSME segment is steadily improving post GST roll-out, we expect further improvement in Bank’s operating performance. Rolling over our valuation to FY20E, we reiterate our BUY recommendation on the stock with a Target Price of Rs247 based on 2.4x FY20E Adjusted book value.

Previous Read : The Capital Asset Pricing Model: An Overview