Overview:-

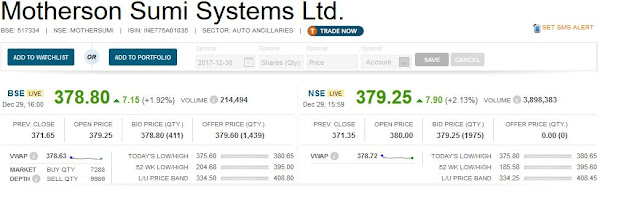

Motherson Sumi Systems Ltd., incorporated in the year 1986, is a Large Cap company (having a market cap of Rs 79749.12 Crore) operating in Auto Ancillaries sector.

Motherson Sumi Systems Ltd. key Products/Revenue Segments include Auto Electricals which contributed Rs 6640.60 Crore to Sales Value (94.01 % of Total Sales), Traded Goods which contributed Rs 216.60 Crore to Sales Value (3.06 % of Total Sales), Other Operating Revenue which contributed Rs 98.20 Crore to Sales Value (1.39 % of Total Sales), Sale of services which contributed Rs 72.90 Crore to Sales Value (1.03 % of Total Sales), Scrap which contributed Rs 17.10 Crore to Sales Value (0.24 % of Total Sales), Export Incentives which contributed Rs 15.40 Crore to Sales Value (0.21 % of Total Sales) and Job Work which contributed Rs 2.40 Crore to Sales Value (0.03 % of Total Sales)for the year ending 31-Mar-2017.

For the quarter ended 30-09-2017, the company has reported a Consolidated sales of Rs 13338.21 Crore, up 2.86 % from last quarter Sales of Rs 12966.82 Crore and up 33.14 % from last year same quarter Sales of Rs 10018.09 Crore Company has reported net profit after tax of Rs 552.97 Crore in latest quarter.

The company’s top management includes Mr.Arjun Puri, Mr.Gautam Mukherjee, Mr.Laksh Vaaman Sehgal, Mr.Naveen Ganzu, Mr.Pankaj Mital, Mr.Sushil Chandra Tripathi, Mr.Toshimi Shirakawa, Mr.Vivek Chaand Sehgal, Ms.Geeta Mathur, Ms.Noriyo Nakamura. Company has Price Waterhouse Chartered Accountants LLP as its auditoRs As on 30-09-2017, the company has a total of 2,105,289,491 shares outstanding.

Motilal Oswal has initiated coverage with a Buy rating on Motherson Sumi Systems, the auto ancillary firm, citing supportive global trends, strong growth visibility and financial discipline. It has set a target price at Rs 458 per share, implying 23 percent upside over Thursday's closing value.

The research house said the company has enviable track record of strong performance with unwavering focus on capital allocation. MSS has evolved as a partner of choice for all most all original equipment manufacturers (OEMs) in the world, reflecting in increasing share of business and market leadership in all the key businesses that it operates in.

It is in sweet spot to benefit from evolving disruptive global automotive trends, which would drive its next wave of growth, it feels.

Motilal Oswal said MSS is now entrenched in the virtuous cycle of “scale begets scale”, as it would significantly benefit from OEMs focus on vendor consolidation.

MSS has strong organic growth opportunities in international as well as domestic market driven by increase in content per vehicle, strong order book and entry in new markets/segment.

The research house estimates MSS’s consolidated revenues/EBITDA/PAT to grow 22/30/33.5 percent CAGR FY17-20. Consequently, it expects return on capital employed-RoCE (post-tax) to improve to 21.2 percent in FY20 (14.7 percent in FY17).

In May 2015, MSS had shared its Vision 2020, targeting revenues of USD 18 billion, RoCE of 40 percent and payout of 40 percent. Of USD 18 billion revenues, it was expected organic revenues of USD 12.4 billion and balance USD 5.6 billion through M&A. M&A has been strategic tool for MSS to strengthen its relationship with customers and get more share of business.

"While acquisitions will play key role to attain revenue targets, management is very clear that acquisitions have to pass its 40 percent RoCE hurdle rate in 4-5 years," Motilal Oswal said.

The Road ahead : -

Motherson Sumi Systems is the flagship company of the Samvardhana Motherson Group. The company was promoted in 1986 in JV with Sumitomo Wiring Systems and Sojitz Corporation of Japan.

MSSL had started out as a single product (wiring harness) company, but has since expanded its product range to include polymer products (through SMP), automotive mirrors (through SMR) and elastomers. The group has four divisions namely the wiring harness (15 percent), polymers (52 percent), mirrors (28 percent) and others components (5 percent).

The latest acquisition of PKC (100 percent owned) strengthens MSS presence in commercial vehicle wiring harness segment. The group operates 230 plants in 37 countries and employs over 1,00,000 people.

Motherson Sumi: Rating BUY | Target - Rs 458

Motherson Sumi has four divisions wiring harness (15 percent), polymers (52 percent), mirrors (28 percent) and others components (5 percent), operates 230 plants in 37 countries and has an enviable track record of strong performance with an unwavering focus on capital allocation.

It is in a sweet spot to benefit from evolving disruptive global automotive trends, which would drive its next wave of growth. The latest acquisition of PKC strengthened its presence in commercial vehicle wiring harness segment.

Premium valuations are justified considering sharp improvement in post-tax RoCE (around 21.2 percent in FY20 versus average around 13.4 percent in last 5 years) and the possibility of stronger than expected earnings growth. Value the stock at 25x FY20E consolidated EPS with target price Rs 458.

Next Read : S H Kelkar:India's Largest Fragrances maker

Previous Read: Mahanagar Gas: A Power Packed Gas Distributor

Motherson Sumi Systems Ltd., incorporated in the year 1986, is a Large Cap company (having a market cap of Rs 79749.12 Crore) operating in Auto Ancillaries sector.

Motherson Sumi Systems Ltd. key Products/Revenue Segments include Auto Electricals which contributed Rs 6640.60 Crore to Sales Value (94.01 % of Total Sales), Traded Goods which contributed Rs 216.60 Crore to Sales Value (3.06 % of Total Sales), Other Operating Revenue which contributed Rs 98.20 Crore to Sales Value (1.39 % of Total Sales), Sale of services which contributed Rs 72.90 Crore to Sales Value (1.03 % of Total Sales), Scrap which contributed Rs 17.10 Crore to Sales Value (0.24 % of Total Sales), Export Incentives which contributed Rs 15.40 Crore to Sales Value (0.21 % of Total Sales) and Job Work which contributed Rs 2.40 Crore to Sales Value (0.03 % of Total Sales)for the year ending 31-Mar-2017.

For the quarter ended 30-09-2017, the company has reported a Consolidated sales of Rs 13338.21 Crore, up 2.86 % from last quarter Sales of Rs 12966.82 Crore and up 33.14 % from last year same quarter Sales of Rs 10018.09 Crore Company has reported net profit after tax of Rs 552.97 Crore in latest quarter.

The company’s top management includes Mr.Arjun Puri, Mr.Gautam Mukherjee, Mr.Laksh Vaaman Sehgal, Mr.Naveen Ganzu, Mr.Pankaj Mital, Mr.Sushil Chandra Tripathi, Mr.Toshimi Shirakawa, Mr.Vivek Chaand Sehgal, Ms.Geeta Mathur, Ms.Noriyo Nakamura. Company has Price Waterhouse Chartered Accountants LLP as its auditoRs As on 30-09-2017, the company has a total of 2,105,289,491 shares outstanding.

Motilal Oswal has initiated coverage with a Buy rating on Motherson Sumi Systems, the auto ancillary firm, citing supportive global trends, strong growth visibility and financial discipline. It has set a target price at Rs 458 per share, implying 23 percent upside over Thursday's closing value.

The research house said the company has enviable track record of strong performance with unwavering focus on capital allocation. MSS has evolved as a partner of choice for all most all original equipment manufacturers (OEMs) in the world, reflecting in increasing share of business and market leadership in all the key businesses that it operates in.

It is in sweet spot to benefit from evolving disruptive global automotive trends, which would drive its next wave of growth, it feels.

Motilal Oswal said MSS is now entrenched in the virtuous cycle of “scale begets scale”, as it would significantly benefit from OEMs focus on vendor consolidation.

MSS has strong organic growth opportunities in international as well as domestic market driven by increase in content per vehicle, strong order book and entry in new markets/segment.

The research house estimates MSS’s consolidated revenues/EBITDA/PAT to grow 22/30/33.5 percent CAGR FY17-20. Consequently, it expects return on capital employed-RoCE (post-tax) to improve to 21.2 percent in FY20 (14.7 percent in FY17).

In May 2015, MSS had shared its Vision 2020, targeting revenues of USD 18 billion, RoCE of 40 percent and payout of 40 percent. Of USD 18 billion revenues, it was expected organic revenues of USD 12.4 billion and balance USD 5.6 billion through M&A. M&A has been strategic tool for MSS to strengthen its relationship with customers and get more share of business.

"While acquisitions will play key role to attain revenue targets, management is very clear that acquisitions have to pass its 40 percent RoCE hurdle rate in 4-5 years," Motilal Oswal said.

The Road ahead : -

Motherson Sumi Systems is the flagship company of the Samvardhana Motherson Group. The company was promoted in 1986 in JV with Sumitomo Wiring Systems and Sojitz Corporation of Japan.

MSSL had started out as a single product (wiring harness) company, but has since expanded its product range to include polymer products (through SMP), automotive mirrors (through SMR) and elastomers. The group has four divisions namely the wiring harness (15 percent), polymers (52 percent), mirrors (28 percent) and others components (5 percent).

The latest acquisition of PKC (100 percent owned) strengthens MSS presence in commercial vehicle wiring harness segment. The group operates 230 plants in 37 countries and employs over 1,00,000 people.

The latest investor presentation is detailed enough to give comfort to investors on the current status as well as future outlook.

MSSL has been able to integrate & consolidate the new companies very successfully and is heading towards its consolidated revenue target of $18 billion, 40% RoCE by 2020. Also, the Indian business is very small compared to the overall revenues as the clientele is wide and diversified across many countries.

Started in 1975, as a partnership between Late Mrs. Swaran Lata Sehgal and her son Mr. Vivek Chaand Sehgal, MSSL has grown into one of the largest provider of automotive components, operating 230 facilities in 37 countries and 24 joint venture partners.

The current status of the company looks decent, but investors have to understand that the debt is on the higher side due to multiple acquisitions.

Hence the high depreciation and interest cost, as seen in the quarterly results. The depr.+int. cost accounts for 38% of the net profits, which is quite large, but understandable due to continuous acquisitions over the years.

The company has informed that starting 2020, they would want to maintain the dividend payout at 40% of net profit. This would be very rewarding for the investors, who are interested in dividend growth stocks for investment.

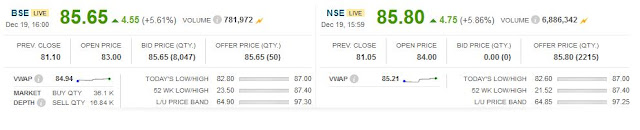

At the same time, the stock has given good returns in the form of capital appreciation. The 10 year return is close to 1700%, a 5 year return of 560%, a 1 year return of 87%. No investor would be disappointed with these returns !!!

Future Prospects:

The company is growing at a decent pace and with the new acquisitions, MSSL is trying to capture a large share of the ‘vehicle wallet’. The company’s contribution to manufacturing of each full vehicle is tremendous.

The Revenue, Margins and RoCE are on a growth trajectory and there is scope for improvement only.

The company has loyal clientele spread across countries and companies, and recently MSSL has added Tesla, Bombardier, Alstom, Rolling Stock as their new clients.

With this outlook and positive framework, the company is well poised to grow by leaps and bounds, while rewarding the investors sufficiently, by means of capital gains as well as their new dividend policy.

Investors can choose this stock from a long term investment perspective and keep adding to the portfolio regularly, on large dips in the stock price.

Motherson Sumi has four divisions wiring harness (15 percent), polymers (52 percent), mirrors (28 percent) and others components (5 percent), operates 230 plants in 37 countries and has an enviable track record of strong performance with an unwavering focus on capital allocation.

It is in a sweet spot to benefit from evolving disruptive global automotive trends, which would drive its next wave of growth. The latest acquisition of PKC strengthened its presence in commercial vehicle wiring harness segment.

Premium valuations are justified considering sharp improvement in post-tax RoCE (around 21.2 percent in FY20 versus average around 13.4 percent in last 5 years) and the possibility of stronger than expected earnings growth. Value the stock at 25x FY20E consolidated EPS with target price Rs 458.

Next Read : S H Kelkar:India's Largest Fragrances maker

Previous Read: Mahanagar Gas: A Power Packed Gas Distributor